Open Trading Account Online

Steps to open Trading Account Online with Tradebulls

Step 1: Click here to get started

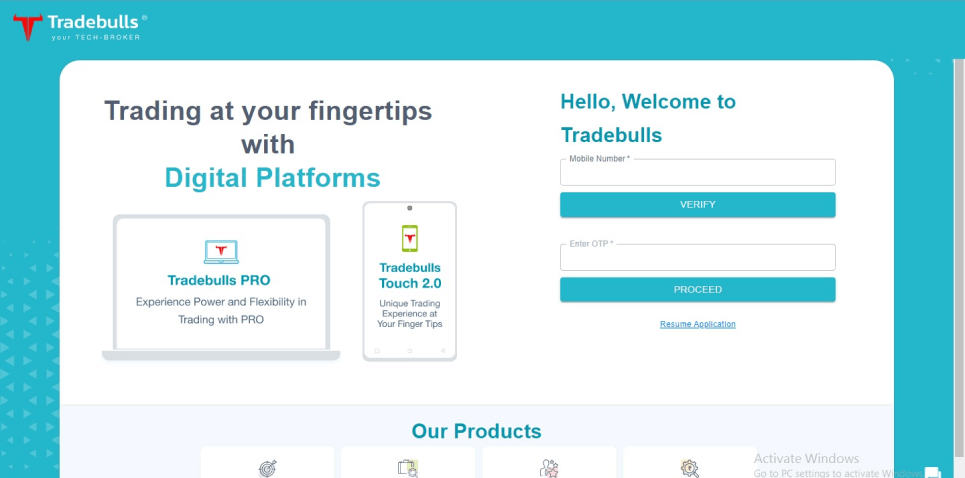

Step 2: Enter your contact number and OTP sent to your contact number for verification

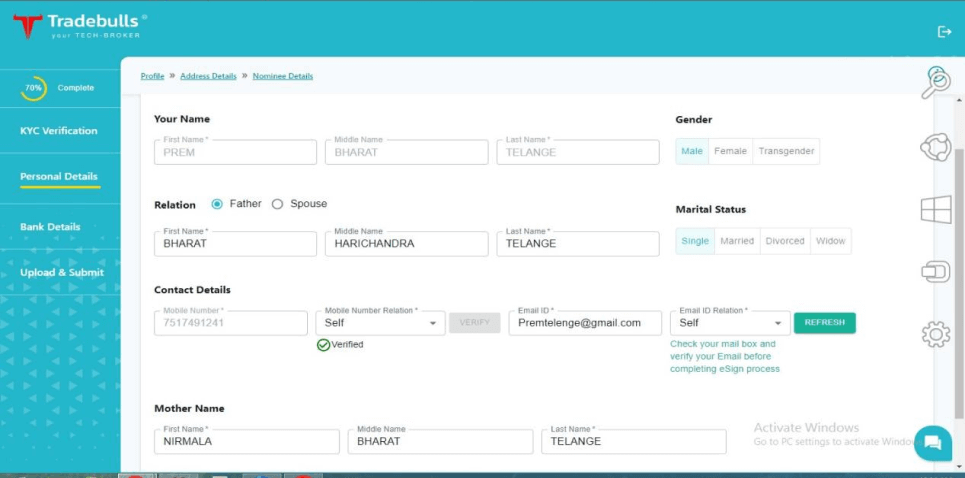

Step 3: Fill in the required details

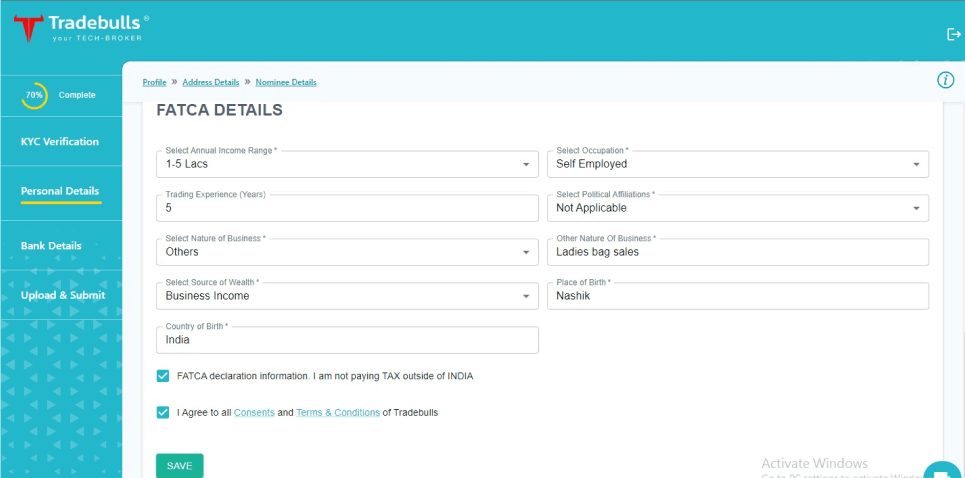

Step 4: Fill in the FATCA (The Foreign Account Tax Compliance Act) details

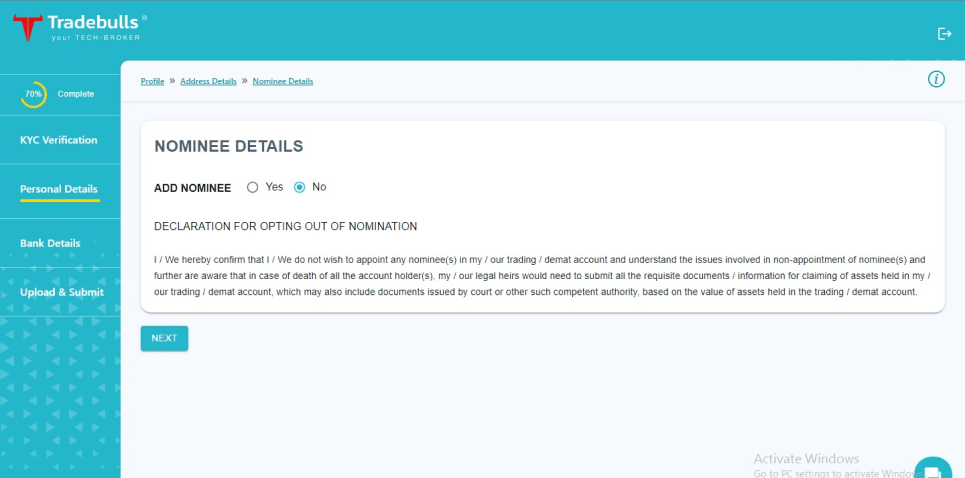

Step 5: Add in your nominee details if any

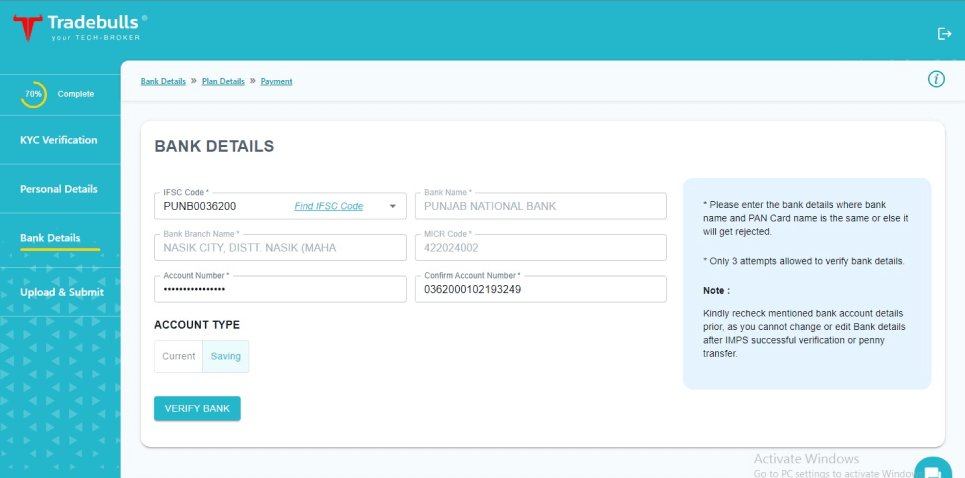

Step 6: Add the required bank details

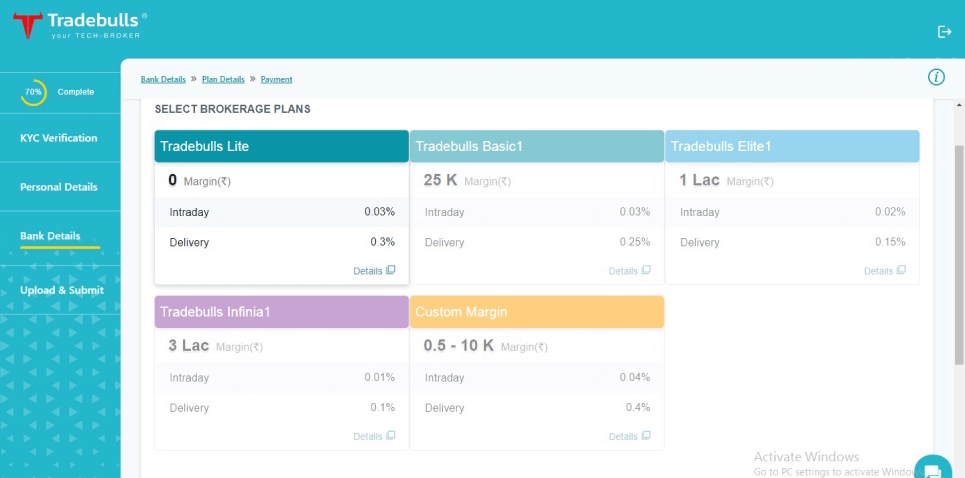

Step 7: Select the brokerage plan of your choice

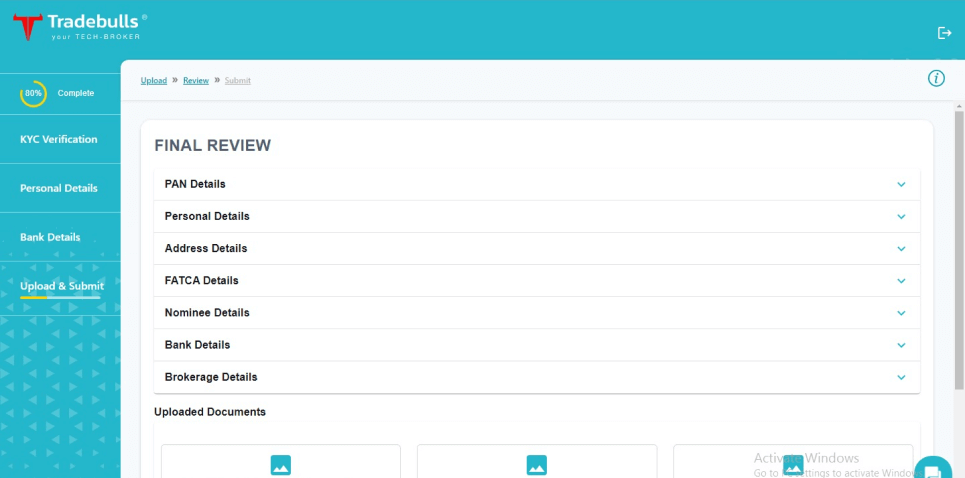

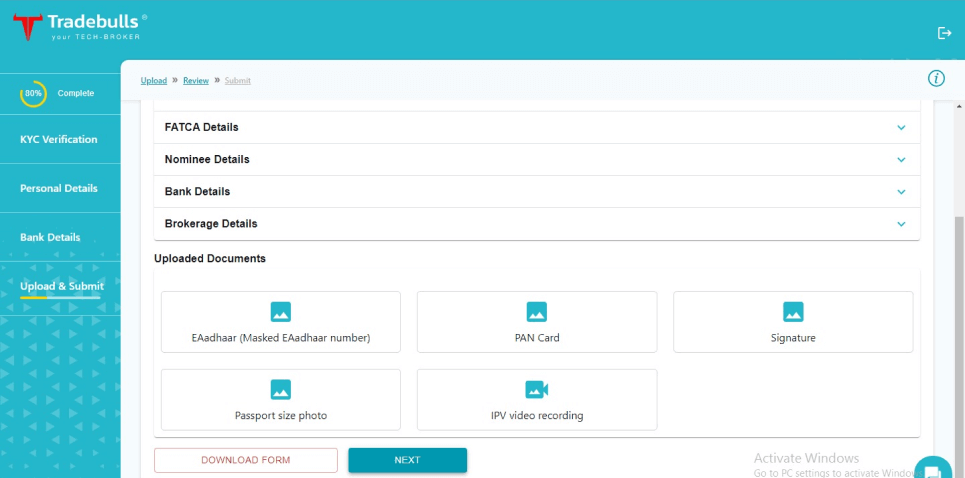

Step 8: Review all the filled in details

Step 9: Upload the required documents

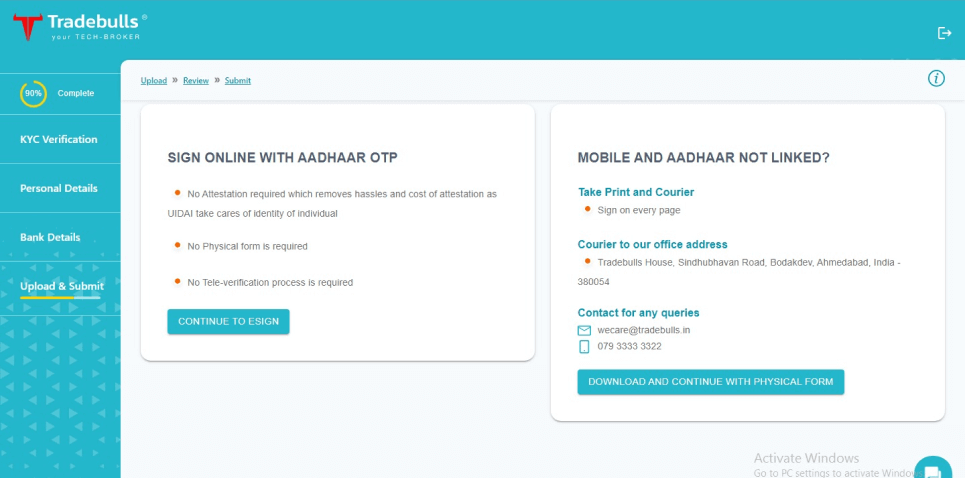

Step 10: Digitally sign your document with your Aadhar number

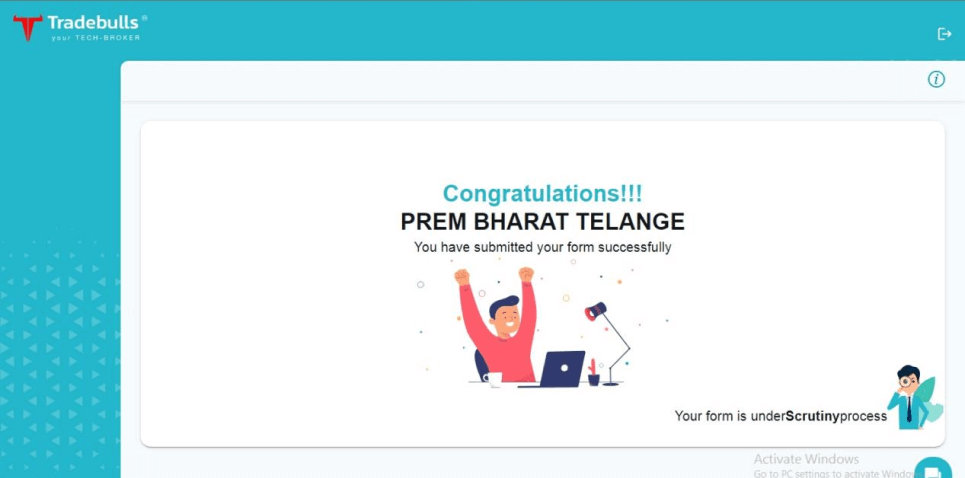

Step 11: Your Online Trading account form is submitted for verification

Benefits of Online Trading

Trade from anywhere, anytime

Enjoy competitive brokerage fees and transparent charges

Lightning-fast order execution to capitalize on market opportunities

Invest in multiple markets

Instant access to latest market updates

Daily Online research reports

How Tradebulls makes online trading easy?

Trade across a range of equities, derivatives, commodities, currencies, and mutual funds, on a single platform

Gain valuable insights with in-depth research reports, market analysis

Experienced, Responsive and Trustworthy Relationship Managers

Competitive Brokerage Fees

Exceptional Customer Support