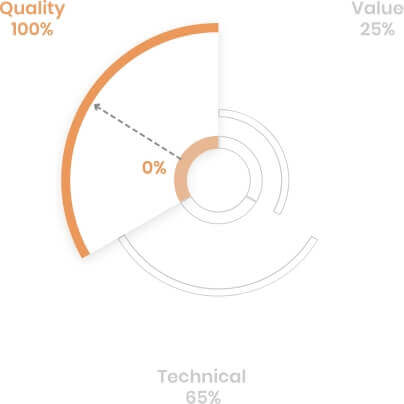

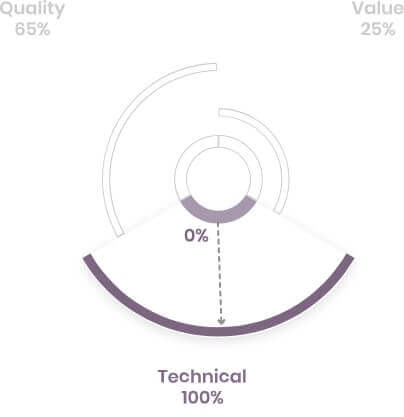

Quality Score

Valuation Score

Technical Score

Peer Comparison

All values except ratios in INR(Crores)

Quarterly Results

All values except ratios in INR(Crores)

Annual Results

All values except ratios in INR(Crores)

Financial Ratios

All values except ratios in INR(Crores)

Balance Sheet

All values except ratios in INR(Crores)

Cash Flow

All values except ratios in INR(Crores)

What is QVT?

Quality

The Quality Score is based on company's financial and management quality and long term performance. Quality scores above 55 are considered good (G) and below 35 are considered bad (B). Whereas, scores between 35-55 are considered neutral/Medium/Middle (M).

- 10055Good (G) Q

- 35Neutral, Medium, Middle (M) Q

- 0Bad (B) Q

Value

The Valuation Score tracks how expensive the stock is versus its peers. Valuation scores above 50 are considered good (G) and below 30 are considered bad (B). Scores between 30-50 are considered neutral/Medium/Middle (M).

- 10050Good (G) Q

- 30Neutral, Medium, Middle (M) Q

- 0Bad (B) Q

Technical

The Technical Score tracks the bullishness or bearishness of a particular stock relative to the entire stock universe. A Technical Score above 59 is considered good (G) and below 30 is considered bad (B). Scores between 30-59 are considered neutral/Medium/Middle (M).

- 10059Good (G) Q

- 30Neutral, Medium, Middle (M) Q

- 0Bad (B) Q

S

Strengths

W

Weaknesses

O

Opportunities

T

Threats